Financial Advisor Business Plan: Step-by-Step Guide for Success in 2025

Learn how to create a financial advisor business plan in 2025. Step-by-step guide with goals, strategies, examples, and U.S. insights for growth.

In 2025, a well-prepared Financial Advisor Business Plan works like a roadmap for your firm. It highlights your ideal clients, outlines the services you’ll offer, details how you’ll build visibility, and tracks the financial goals that matter. With this in place, you simplify operations, make smarter choices, and move forward with confidence.

Success in financial advising doesn’t come by luck—it comes from strategy. A financial advisor business plan gives you structure to grow, track performance, and handle challenges in 2025. From setting your mission to planning revenue goals, this type of plan helps you create stability while reaching new opportunities. In this article, we are going to break down the key parts of a financial advisor business plan and provide practical steps, examples, and U.S. insights you can use to build your own path to success.

Why Every Financial Advisor Needs a Business Plan

Many financial advisors begin their careers eager to serve clients but overlook the importance of having a clear plan in place. Without structure, it’s easy to lose focus, spread yourself too thin, or miss growth opportunities. A financial advisor business plan serves as your guide—it defines your goals, sets measurable milestones, and keeps your practice moving in the right direction. It also builds credibility with potential clients, partners, and investors by showing that you have a well-thought-out strategy. Just as importantly, it helps you make informed decisions about marketing, hiring, operations, and finances. With a plan, you work proactively instead of reactively; without one, you risk running your business on autopilot, which often leads to stress, inefficiency, and missed chances to grow.

Defining Your Mission and Vision

Every strong financial advisor business plan begins with two guiding elements: a mission statement and a vision statement. The mission explains your purpose today — who you serve, what value you provide, and why clients should trust you. For example, your mission might be “to help middle-income families build financial security through transparent, fee-based planning.” The vision looks ahead — it paints a picture of where you want your practice to be in the future. This could mean becoming the most trusted advisor in your region, expanding into new markets, or managing a specific amount of assets under management (AUM) within five years. Writing these statements gives you clarity, keeps your team aligned, and signals to clients that your firm is built on strong values and long-term goals.

Understanding Your Target Market

A strong financial advisor business plan starts with a clear picture of who you want to serve. Your clients might be retirees looking for steady income, young professionals saving for their first home, small business owners managing cash flow, or high-net-worth families planning for legacy and estate transfers. Each group has unique priorities and decision-making styles, so identifying them early helps you design services that truly fit their needs.

Market research is key here. You can gather insights from sources like U.S. Census data, Pew Research reports, and industry surveys that show how different age and income groups manage money. For example, many younger professionals prefer digital tools, mobile apps, and quick communication, while retirees often value personal meetings, clear explanations, and long-term security planning. Small business owners may prioritize tax efficiency and succession planning, whereas high-net-worth households often want advanced estate and investment strategies.

By understanding your audience in detail—what they care about, how they communicate, and where they seek advice—you can create services and marketing messages that resonate. This not only makes your financial advisor business plan more realistic but also gives you a competitive edge in attracting and keeping the right clients.

Looking for inspiration on how to stand out when promoting your services? Check out these 10 creative junk removal business card ideas that get you noticed for fresh design tips.

Analyzing Competitors

No business operates in a vacuum, and financial advisors face competition at every level—local firms, independent planners, and even large institutions offering similar services. Including competitor analysis in your financial advisor business plan helps you understand the landscape you’re working in and gives you insight into how to position yourself effectively. Start by researching what other advisors in your area or niche are offering: review their service packages, pricing models (such as assets under management fees versus flat fees), and the types of clients they target. Look closely at their websites, social media presence, and online reviews to see what clients value most and where frustrations lie. This process not only highlights opportunities to differentiate your services but also reveals potential gaps in the market—like underserved client groups or specialized financial planning needs. By knowing where you stand against competitors, you can refine your unique value proposition and develop strategies that make your practice more appealing and trustworthy to potential clients.

Building Your Service Offering

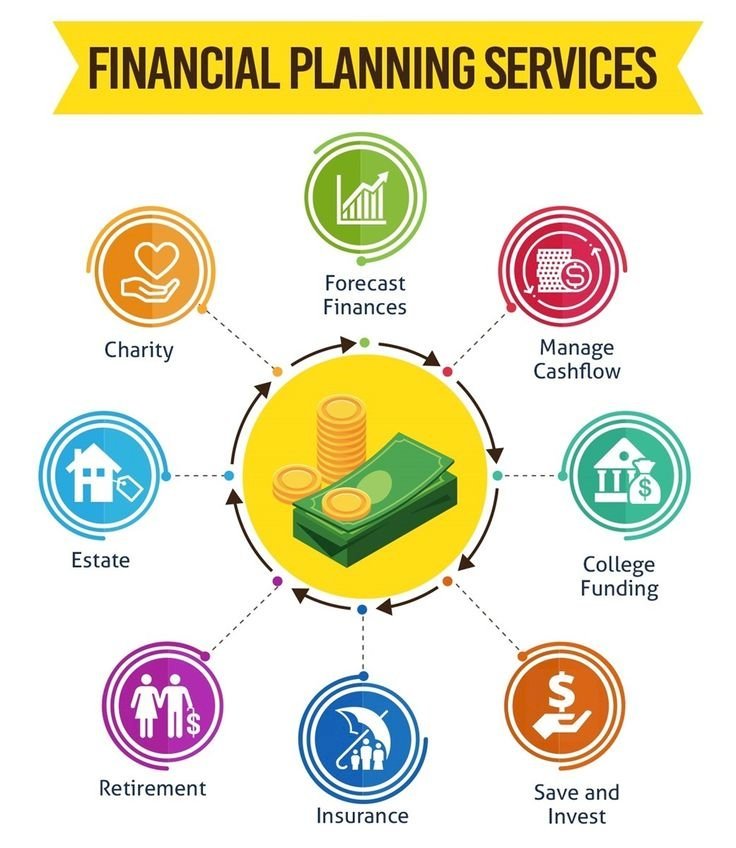

One of the most important parts of a financial advisor business plan is defining exactly what services you provide. Being clear about your offerings not only helps potential clients understand the value you bring but also keeps you focused on the areas where you can deliver the strongest results. Most advisors provide core services such as retirement planning, investment management, tax-efficient strategies, and estate planning. Others expand into areas like education savings plans, insurance analysis, or small-business succession planning.

You might also decide to specialize in a niche—such as working with physicians, tech professionals, or family-owned businesses. Research from Cerulli Associates shows that advisors who target specific client segments often experience higher client loyalty and faster growth because their services feel more personalized. Documenting these choices in your business plan ensures that your marketing, pricing, and client communications are aligned with the services you want to be known for. A well-defined service offering not only sets expectations early but also makes it easier to stand out in a competitive marketplace.

Setting Clear Goals and Objectives

A business plan without goals is just an idea. Your financial advisor business plan should include measurable goals such as the number of clients you want to serve, revenue targets, or retention rates. Break these down into short-term (one year) and long-term (five years) goals. Make sure they are realistic and measurable, so you can track progress over time. Setting goals gives you motivation and makes it easier to adjust strategies if you’re falling short.

Marketing and Client Acquisition

Getting new clients is one of the biggest challenges advisors face. Your plan should include a detailed marketing strategy that explains how you will attract, convert, and retain clients. Options include social media, email marketing, networking events, referral programs, and paid advertising. In 2025, digital marketing continues to dominate, so a strong online presence is essential. A clear strategy ensures you spend your time and budget effectively while maximizing client growth.

If you’re interested in how wellness trends are being shaped across communities, check out our deep dive on Exploring Black Health & Wellness: Influencers and Brands Leading the Way (2025)

Building a Strong Online Presence

More than 80% of people now search online before choosing a financial service. That’s why your financial advisor business plan should include a focus on your website, SEO, and social media. A professional website with clear service descriptions and testimonials builds credibility. Regular blog posts or financial tips can also improve visibility on Google. Adding client reviews, Google Business listings, and LinkedIn engagement can help you attract clients who might never find you otherwise.

Operations and Workflow

Smooth operations make a big difference in client satisfaction. Your business plan should explain how you will manage daily tasks like scheduling, billing, compliance, and reporting. Investing in financial planning software or customer relationship management (CRM) tools can save hours each week. By setting up efficient workflows, you can handle more clients without feeling overwhelmed. This section also shows potential investors or partners that you are serious about running a professional business.

Staffing and Team Planning

If you plan to grow, you may not be able to handle everything alone. A financial advisor business plan should outline when and how you will hire staff. This could include administrative assistants, junior advisors, or marketing specialists. Clearly defining roles makes it easier to scale and ensures you have support where you need it most. A strong team structure allows you to focus on high-value tasks like client meetings and strategic planning.

Financial Projections

One of the most important sections of your business plan is financial forecasting. This includes revenue projections, expenses, and profit margins. Showing numbers gives your plan credibility and helps you prepare for challenges. For example, include expected revenue from different services, operating costs, and marketing budgets. Having this data makes it easier to secure loans, attract investors, and avoid unexpected cash flow issues.

Average Annual Revenue for U.S. Financial Advisors in 2025

|

Service Type |

Average Revenue per Client (USD) |

% of Advisors Offering |

|

Retirement Planning |

$2,500 |

72% |

|

Tax and Estate Planning |

$3,200 |

55% |

|

Wealth Management Packages |

$5,800 |

41% |

|

Small Business Consulting |

$4,000 |

28% |

Source: U.S. Bureau of Labor Statistics & Market Research Estimates, 2024–2025

For entrepreneurs interested in setting up or managing a company in California, check out our guide on the California Business Portal: Your Ultimate Guide to Starting & Managing a Business

Budgeting and Cost Control

Running a financial advisory practice comes with costs like office rent, compliance fees, software, and staff salaries. A good plan should include a detailed budget that tracks these expenses. Without clear cost control, it’s easy to overspend and cut into your profits. Setting a budget keeps your business sustainable and ensures you’re prepared for future growth. A lean budget also makes it easier to reinvest profits into marketing or expansion.

Compliance and Legal Considerations

The financial services industry is heavily regulated, and ignoring compliance can be disastrous. Your financial advisor business plan should explain how you’ll meet state and federal requirements. This includes licensing, continuing education, record-keeping, and data protection. By building compliance into your plan, you protect yourself from penalties and build client trust. Clients are more likely to choose an advisor who demonstrates professionalism and accountability.

Risk Management

Every business faces risks, from market downturns to technology failures. A good financial advisor business plan should address how you will prepare for these challenges. For example, what happens if your biggest client leaves? How will you handle a sudden drop in the stock market? Having a plan for risk management ensures your business stays strong even when times are tough. It also shows clients and investors that you are forward-thinking.

Reviewing and Updating Your Plan

A business plan is not something you write once and forget. To be effective, it needs regular updates. At least once a year, review your goals, financials, and strategies to make sure they still fit your situation. Updating your financial advisor business plan keeps you flexible and prepared for changes in the market or your business. Treat it as a living document that grows along with your practice.

Using Technology to Improve Efficiency

Technology has transformed financial services, and smart advisors take advantage of it. Adding a section on technology to your plan shows that you’re keeping up with industry trends. Tools like robo-advisors, automated reporting, and AI-driven planning software can help you serve more clients with less effort. In 2025, clients expect digital convenience, so technology is no longer optional—it’s essential for staying competitive.

Growth and Expansion Strategies

As your practice grows, you’ll want to expand services or reach new markets. Your business plan should explain how you’ll do this, whether it’s by opening new offices, offering virtual advising, or partnering with other professionals like CPAs. Expansion doesn’t have to be huge—it can be as simple as targeting a new niche market. Writing this into your financial advisor business plan helps you stay focused on long-term growth.

Client Retention Strategies

Attracting new clients is important, but keeping existing ones is often more profitable. Research shows that retaining clients is up to five times cheaper than acquiring new ones. A strong financial advisor business plan should include strategies for retention such as regular check-ins, quarterly reviews, personalized financial updates, and sending newsletters with timely advice. Building long-term trust not only secures ongoing revenue but also increases referrals since happy clients are more likely to recommend your services to family and friends. Retention should be just as much of a priority as acquisition in your overall strategy.

If you’re also interested in exploring digital opportunities beyond financial services, check out our guide on How Influencers Make Passive Income: 22 Proven Strategies for Sustainable Earnings for ideas that can inspire sustainable growth in any business model.

Branding for Financial Advisors

Branding is not just for large corporations—it matters just as much for individual advisors. A clear brand identity builds trust, sets you apart from competitors, and makes your services memorable. In your financial advisor business plan, include a section on branding that outlines your logo, colors, messaging, and tone of communication. For example, some advisors emphasize a “family-first” approach, while others highlight “growth and wealth-building.” Strong branding ensures consistency across your website, social media, and printed materials, helping you attract the right type of client.

Networking and Partnerships

Networking is a time-tested growth strategy that should be written into every business plan. Financial advisors can benefit greatly from building partnerships with CPAs, attorneys, real estate professionals, and small business consultants. These professionals often refer clients who need financial guidance, making referrals a low-cost, high-impact marketing channel. For example, a partnership with a tax professional can help you provide holistic advice that addresses both financial planning and tax strategies. Including a networking strategy in your plan demonstrates long-term thinking and helps you build a sustainable pipeline of new clients.

Technology and Cybersecurity

As financial advisors handle sensitive personal and financial data, cybersecurity is a growing concern. In addition to improving efficiency, your financial advisor business plan should also include measures for protecting client information. This might involve using encrypted client portals, secure video conferencing platforms, and strict password policies. By planning for cybersecurity, you reassure clients that their personal and financial details are safe, which is becoming an increasingly important factor in client decision-making. Investing in security tools is just as important as investing in marketing or technology.

Succession Planning

Many advisors focus on starting and growing their practice but forget about what happens when they retire or face unexpected events. A strong financial advisor business plan should include a succession plan that outlines how your business will continue if you step away. This might involve training a junior advisor, preparing a family member to take over, or selling your practice. Succession planning not only provides peace of mind but also increases the value of your business as an asset. Clients are more likely to trust an advisor who has a clear continuity plan.

Case Study: A Growing Advisory Practice

Consider Sarah, a Certified Financial Planner (CFP) who started her own practice in 2018. She created a financial advisor business plan that included her mission, service offerings, marketing strategies, and financial projections. By 2023, she had doubled her client base, largely due to her clear online branding and a referral program built into her plan. She also added junior staff as outlined in her staffing plan, which freed up her time to focus on high-value clients. This example shows how a structured plan doesn’t just help you start but also helps you scale and adapt over time.

Client Acquisition Cost vs Retention Cost in the U.S. (2025)

|

Metric |

Average Cost (USD) |

Notes |

|

Acquiring a New Client |

$1,200 |

Includes marketing and onboarding |

|

Retaining an Existing Client |

$250 |

Includes communication and reviews |

Source: U.S. Financial Services Market Research, 2024–2025

Looking to highlight the value of career planning beyond business strategy? Check out our guide on National Intern Day 2025: When It Is, How to Celebrate & Why It Matters to see how supporting interns can strengthen your firm’s future talent pipeline.

Industry Statistics for Financial Advisors in the U.S.

According to the U.S. Bureau of Labor Statistics (2024), the average annual income for financial advisors is about $95,390, with the top 10% earning more than $200,000. Employment opportunities for advisors are projected to grow by 13% between 2022 and 2032, faster than the average for all occupations. This steady growth highlights why having a financial advisor business plan is so important—it prepares you to take advantage of industry demand while staying ahead of competitors.

Top Marketing Channels for Financial Advisors in 2025

|

Marketing Channel |

Effectiveness (%) |

Average Monthly Cost |

|

SEO & Content |

72% |

$1,500 |

|

Referrals |

68% |

$500 |

|

Paid Ads |

55% |

$2,000 |

|

Social Media |

49% |

$1,000 |

Source: U.S. Digital Marketing Insights Report, 2024–2025

Conclusion

A financial advisor business plan is more than just a document—it’s the foundation of your practice’s success. By including your mission, target market, services, operations, finances, and growth strategies, you create a roadmap that keeps you on track in 2025 and beyond. The key is to treat your plan as a living guide that evolves with your business. With clear goals and smart strategies, you’ll be ready to grow with confidence and give your clients the best possible service.

FAQs

What is a financial advisor business plan?

It’s a written roadmap that explains how a financial advisor will operate, serve clients, manage money, and grow over time.

Why do I need a financial advisor business plan?

It helps you set goals, attract clients, and stay organized. Without one, it’s harder to grow in a competitive market.

How often should I update my business plan?

Most advisors review and update their plan once a year, but you should also make changes if your market or goals shift.

What should be included in the plan?

Key elements include mission statement, target market, services, financial projections, marketing strategy, and compliance practices.

Can I use a template to create my plan?

Yes, many advisors start with a financial advisor business plan template. It makes the process faster while ensuring you don’t miss key sections.

Selina Smith

Selina Smith