Mini Storage Business for Sale in 2025: Find, Evaluate & Invest with Confidence

Looking to buy a mini storage business in 2025? Discover how to find, evaluate, and invest in profitable storage facilities for long-term passive income.

Discover why mini storage businesses are booming in 2025. Learn how to find profitable listings, assess returns, and invest confidently in self-storage.

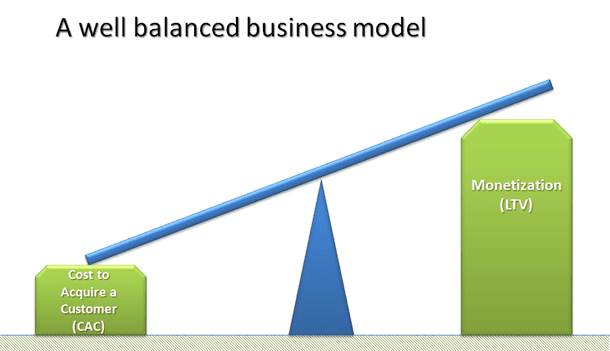

In 2025, mini storage businesses have become one of the fastest-growing commercial property investments, with the U.S. self-storage industry valued at nearly $50 billion, according to the Self Storage Association. Rising housing costs, urban downsizing, the growth of e-commerce, and the shift toward remote work have all fueled demand. More Americans are finding themselves short on space and turning to storage facilities for practical, affordable solutions. Today, more than 1 in 10 U.S. households rent a self-storage unit, and that number continues to climb each year.

For investors, this trend represents a unique opportunity: storage facilities typically offer steady, recession-resistant cash flow with relatively low management needs compared to other real estate assets. But entering the market can feel daunting. Which listings are truly profitable? What red flags should you watch for? And how do you calculate whether a facility will deliver the returns you’re looking for?

In this guide, we’ll explain how to find mini storage businesses for sale, analyze their income potential, and make smart investment decisions that can generate reliable, long-term passive income.

Google Trends: Mini Storage Demand Is Rising

Image source: encrypted-tbn0.gstatic.com

Between 2024 and 2025, interest in the term “mini storage business for sale” has climbed by over 30%, based on search data from Google Trends. States like Texas, Florida, and Arizona are leading the surge, thanks to growing populations and booming small business activity. This trend aligns with the broader shift toward remote work, downsizing, and online retail—all of which increase the need for secure, flexible storage solutions. As a result, mini storage businesses are becoming one of the most sought-after asset classes for investors seeking stability and recurring income.

What Is a Mini Storage Business?

Image source: i.pinimg.com

A mini storage business, also known as a self-storage facility, rents out individual storage units to people and businesses who need extra space. These units come in various sizes and are usually rented on a month-to-month basis. Customers use them to store personal belongings, furniture, tools, inventory, or seasonal items. What makes mini storage different from traditional moving or warehousing services is that it’s fully self-service—tenants handle their own access and belongings. For the owner, this means low staffing needs, simple operations, and reliable monthly income. Profits typically come from unit rentals, late payment fees, insurance sales, and optional services like packing supplies or online booking.

Types of Mini Storage Facilities

Image source: i.pinimg.com

Mini storage businesses offer various formats to meet the diverse storage needs of both individuals and businesses. Understanding these types helps investors choose the right facility model based on customer demand, operational complexity, and local regulations.

- Drive-Up Storage:

These are the most common units, resembling garage spaces where tenants can drive up and unload items directly from their vehicles. They’re easy to access and cost-effective to maintain, making them ideal for suburban or highway-accessible locations. - Climate-Controlled Storage:

Located indoors, these units are equipped with HVAC systems to maintain consistent temperature and humidity levels. They're essential in areas with extreme weather and are preferred by renters storing electronics, documents, antiques, or delicate goods. - RV and Vehicle Storage:

Designed for storing boats, RVs, trailers, and cars. They may be uncovered outdoor spaces, covered canopies, or enclosed large units. These are in high demand in areas near lakes, recreational parks, or dense suburbs with limited parking. - Portable Storage Units:

Also known as mobile storage, these units are delivered to customers’ properties, loaded at their convenience, and then picked up for off-site storage. While they require more logistics, they’re popular in moving-heavy markets or as add-ons to traditional facilities.

Each storage model has different operating costs, licensing needs, and income potential. Investors should evaluate the local market's preferences, zoning laws, and climate before choosing which format to buy or build.

Why 2025 Is Ideal for Investing in Mini Storage

Image source: encrypted-tbn0.gstatic.com

In 2025, the self-storage industry is projected to exceed $60 billion in market size, driven by strong consumer demand and shifting lifestyle patterns (Source: IBISWorld, 2024). Mini storage remains one of the most recession-resilient segments in real estate due to its low overhead, flexible leasing, and consistent income stream. High occupancy rates—often above 90% in growing suburban and urban areas—reflect ongoing demand from downsizing households, remote workers, and small businesses needing affordable offsite storage. The surge in e-commerce and home-based businesses further fuels the need for reliable, scalable storage solutions.

Storage Unit Sizes and Rental Income: What to Expect in 2025

Image source: i.pinimg.com

Understanding how unit size impacts rental income is essential when evaluating a mini storage business. Each unit type serves a specific customer need and offers varying revenue potential. Here’s a 2025 breakdown based on national averages:

|

Unit Size |

Typical Use |

Average Monthly Rent (USD) |

Return on Investment (ROI) |

|

5x5 |

Small boxes, seasonal items |

$50 – $65 |

High – high turnover, low maintenance |

|

5x10 |

Studio or dorm contents |

$70 – $90 |

High – steady demand, quick fill rate |

|

10x10 |

1-bedroom apartment furnishings |

$110 – $140 |

Moderate – stable, less volatile |

|

10x20 |

Full household or vehicle storage |

$150 – $220 |

Lower margin – fewer units per sq ft |

Source: SpareFoot 2025 Market Analysis & U.S. Self Storage Almanac

Insights:

- Smaller units (5x5, 5x10) offer higher ROI due to consistent demand and lower maintenance costs.

- Larger units generate more income per lease but can take longer to fill and turn over.

- Rental rates can vary based on facility location, features (like climate control), and local competition.

Where to Buy a Mini Storage Business for Sale

Image source: i.pinimg.com

Finding the right mini storage business begins with knowing where to search. Here are the best platforms and methods:

- Online Marketplaces: BizBuySell.com, LoopNet.com, and Crexi feature a wide range of active listings, including turnkey operations and distressed properties.

- Regional and Local Listings: Use commercial MLS databases and CityFeet for state-specific opportunities.

- Brokers and Advisors: Work with commercial brokers or self-storage consultants who specialize in investment-grade facilities.

- Direct Outreach and Auctions: Contact facility owners directly—especially retiring operators—or explore public auctions and foreclosure sales.

Always verify ownership, zoning compliance, permits, environmental reports, and current financial statements before making any offers.

How to Evaluate a Mini Storage Business

Image source: i.pinimg.com

Evaluating a mini storage facility before purchase is essential to avoid costly mistakes and ensure solid returns. Key performance indicators (KPIs) to analyze include:

- Occupancy Rate: Aim for facilities with occupancy above 85%—this indicates consistent demand and stable income.

- Rent Per Square Foot: Compare this to market averages in the region. Underpriced facilities may offer room for rent increases.

- Capitalization Rate (Cap Rate): A healthy cap rate in 2025 ranges between 5% and 8%, depending on location and market conditions.

- Net Operating Income (NOI): Examine 12–24 months of financials. Ensure that expenses like taxes, insurance, and utilities are properly recorded.

- Operating Expenses: Look at cost efficiency. A lean facility may have operating expenses as low as 30–40% of gross income.

- Location and Competition: Choose areas with limited new supply, strong population growth, and high traffic visibility.

Bonus Tip: Also assess value-add opportunities such as:

- Rent increases aligned with local market rates

- Adding climate-controlled units

- Installing automation and security tech

- Space available for expansion or RV/boat storage

Valuing a Mini Storage Business: Cap Rate & NOI

Image source: i.ytimg.com

One of the most trusted methods to determine the value of a mini storage facility is the Capitalization Rate (Cap Rate) formula, commonly used by brokers, appraisers, and banks.

Valuation Formula:

Facility Value = Net Operating Income (NOI) ÷ Cap Rate

Example Calculation:

If a facility generates an annual NOI of $120,000 and the market cap rate is 6%:

$120,000 ÷ 0.06 = $2,000,000 estimated property value

Best Practices:

- Always use trailing 12-month NOI for accuracy

- Verify Cap Rate from local market comps or brokers

- Adjust Cap Rate based on facility risk, age, and tenant profile

This formula gives investors a reliable way to compare deals and ensure the asking price reflects the income potential.

U.S. Regional Storage Occupancy Rates in 2025

Image source: moving.selfstorage.com

Strong occupancy is a critical success metric for mini storage facilities. According to the Self Storage Association (SSA) and Statista’s 2025 market data, national occupancy remains robust:

|

U.S. Region |

Average Occupancy Rate |

|

Northeast |

89% |

|

Southeast |

93% |

|

Midwest |

90% |

|

West Coast |

92% |

|

National Avg |

91% |

Source: SSA Market Report & Statista Data, 2025

These figures highlight continued nationwide demand, particularly in warmer states where population growth and home downsizing trends are strongest. When evaluating a facility, target regions with consistently high occupancy above 90%, as it signals strong local demand and rental stability.

Additional Revenue Stream: Tenant Insurance

Image source: encrypted-tbn0.gstatic.com

Offering tenant insurance is a smart and low-effort way to boost your facility’s bottom line. By partnering with licensed insurance providers, mini storage operators can earn 5% to 10% commission per active policy—without adding extra work. For example, a 200-unit facility with moderate uptake can generate $1,000 to $2,000 per month in additional income.

This service benefits both the facility and its tenants: renters gain peace of mind knowing their items are covered against theft, fire, or water damage, and owners benefit from an extra stream of passive, recurring revenue. Best of all, offering insurance doesn't require raising rents, making it a value-added upsell that improves profitability and tenant satisfaction.

Understanding Acquisition Costs

Investing in a mini storage business involves more than just the purchase price. Understanding all acquisition-related costs helps prevent budget overruns and supports smart decision-making.

Typical acquisition expenses include:

Image source: www.maxio.com

- Purchase Price: Typically ranges from $400,000 to $5 million+, depending on location, unit count, occupancy, and revenue potential.

- Down Payment: Expect to contribute 10% to 30% upfront if financing through banks or SBA.

- Property Inspections & Appraisal: Independent assessments ensure the facility is structurally sound and valued accurately.

- Environmental Assessments: Required in many states to check for soil contamination or prior hazardous use (especially in older or industrial zones).

- Legal & Escrow Fees: Covers contract review, title transfer, and compliance with zoning or permitting laws.

- Upgrades & Renovations: Budget for improvements like repainting, new lighting, access control systems, or converting units to climate-controlled.

Financing options in 2025 include:

Image source: encrypted-tbn0.gstatic.com

- SBA 7(a) Loans: Ideal for first-time buyers. Offers long repayment terms and lower equity requirements.

- Conventional Commercial Loans: Available from banks and credit unions with strong borrower credit and business plans.

- Seller Financing: Some owners offer direct financing with flexible terms, especially for older or underperforming facilities.

Pro Tip: Always request a full Schedule of Real Estate Owned (SREO) and 12-month trailing financials during due diligence to evaluate the true cost and return potential.

Tech in Storage: 2025 Trends

Image source: www.geonfino.com

Smart technology is transforming the mini storage industry in 2025. These digital tools not only reduce operational costs but also enhance the renter experience—making your facility more competitive.

Key Technologies Being Adopted:

- Mobile Gate Access & Smart Locks – Tenants can unlock their units and enter the facility using smartphone apps, eliminating the need for physical keys or on-site staff.

- Remote Video Surveillance – 24/7 camera systems monitored off-site reduce theft and liability while improving customer trust.

- AI-Powered Dynamic Pricing Software – Adjusts rental rates in real time based on occupancy levels, seasonality, and local demand, similar to hotel and airline models.

- Cloud-Based Rental & Payment Platforms – Let renters sign leases, make payments, and manage units entirely online, increasing convenience and reducing paperwork.

These tech upgrades improve tenant satisfaction and make the facility more attractive to passive investors and modern renters alike. Plus, automation allows one person to manage multiple facilities efficiently—making growth more scalable.

Franchise vs. Independent Storage Business

Image source: i.ytimg.com

When deciding between a franchise or an independent storage facility, it’s important to weigh the trade-offs in branding, control, and cost:

|

Model |

Advantages |

Disadvantages |

|

Franchise |

- Brand recognition (e.g., Storage Authority) - Proven systems and support - Marketing and tech tools included |

- Franchise fees and royalties - Less control over pricing and operations |

|

Independent |

- Full control over business decisions - Higher profit margins - Freedom to innovate marketing and pricing |

- No brand visibility - Requires own marketing and systems - Steeper learning curve |

Which one should you choose?

If you're a first-time buyer looking for guidance and brand credibility, a franchise can reduce the learning curve. However, if you prefer flexibility and higher returns, an independent model might be the smarter long-term choice.

Legal & Zoning Must-Knows

Image source: www.simplepinmedia.com

Before purchasing a mini storage facility, it’s critical to ensure legal compliance and zoning approval. Overlooking these steps can result in costly penalties or forced shutdowns.

- Verify Zoning Status: Confirm that the property is zoned for commercial self-storage use through your local city or county planning office. If zoning isn't correct, you may need to apply for a variance or conditional use permit.

- Review Permits & Licenses: Ensure the business has all necessary operating permits and a valid business license. Requirements vary by state and municipality.

- Assess Insurance Needs: Storage operators typically need general liability insurance, property insurance (for buildings and equipment), and workers' compensation if you employ staff. Additional coverage may be required for natural disasters depending on your location.

- Understand Local Regulations: Some jurisdictions have rules about signage, hours of operation, fire safety codes, and ADA accessibility. Ensure the facility meets all local building and safety standards.

- Hire Legal Support: Work with a commercial real estate attorney to review the lease agreements, zoning compliance, purchase contract, and any environmental disclosures. Legal guidance is especially crucial when buying older or nonconforming properties.

Top Mistakes to Avoid When Buying a Mini Storage Business

Image source: encrypted-tbn0.gstatic.com

Avoiding these common errors can save you thousands and prevent long-term headaches:

- Skipping Due Diligence

Failing to thoroughly inspect financial records, leases, and property documents often leads to unpleasant surprises after the purchase. - Overlooking Environmental Contamination

Not checking for prior use of hazardous materials (like oil spills or industrial chemicals) can result in massive cleanup costs. Always request a Phase 1 Environmental Site Assessment. - Neglecting Competitor Research

If there are too many nearby facilities with lower rates or better features, your occupancy and pricing power may suffer. Study the local market before committing. - Overestimating Rental Income

Basing income projections on 100% occupancy or unrealistically high rents is risky. Use actual trailing 12-month figures, not inflated seller estimates. - Ignoring Security and Tech Upgrades

Modern renters expect 24/7 access, cameras, and digital gate entry. Outdated facilities lose appeal quickly. Budget for upgrades to remain competitive.

Owner-Operator vs. Passive Investor: Which Model Fits You Best?

When buying a mini storage business in 2025, one of the first decisions you’ll need to make is whether to run it yourself or hire someone to manage it.

Owner-Operator Model

Image source: www.ohiotrucks.com

- Control: You oversee daily operations, from tenant management to maintenance.

- Profit: Higher profit margins since you save on management fees.

- Effort: Demands time and involvement, ideal for hands-on entrepreneurs or those living near the facility.

- Best For: First-time investors wanting full control and those looking to maximize ROI.

Passive Investor Model

Image source: encrypted-tbn0.gstatic.com

- Management: A third-party property manager handles leasing, maintenance, and customer service.

- Scalability: Easier to own multiple facilities or invest remotely.

- Cost: You’ll pay 6%–10% of gross revenue for management services.

- Best For: Investors seeking passive income, those with multiple real estate assets, or out-of-state buyers.

Pro Tip: Many seasoned investors start as owner-operators to learn the business, then transition to a passive model as they scale.

Profit-Boosting Strategies After You Buy

Image source: businessconsultingagency.com

Once you've acquired a mini storage facility, here are smart strategies to increase profitability without overwhelming overhead:

- Gradually Raise Rental Rates

Adjust rental fees slightly over time to match local market rates. Inform tenants in advance and highlight added value like improved security or amenities. - Introduce Premium Unit Options

Convert a portion of standard units into climate-controlled spaces or add enhanced security features. These upgrades can command 20–30% higher rent. - Offer Ancillary Services

Boost revenue by selling high-margin items like padlocks, boxes, bubble wrap, and packaging tape. Consider offering on-site truck rentals for tenant convenience. - Install Solar Energy Systems

Solar panels can significantly reduce monthly utility bills while also qualifying for tax credits. Over time, the installation cost pays for itself through energy savings.

These enhancements not only raise your net operating income (NOI) but also increase the overall property valuation—making your investment even more profitable long-term.

Marketing Tips to Grow Your Mini Storage Business in 2025

Image source: i.pinimg.com

Effective marketing can make a huge difference in occupancy rates and revenue. Here are actionable and proven strategies for 2025:

- Optimize Your Google Business Profile

Add high-quality photos, respond to reviews, update hours, and use keywords in your business description to improve local search visibility. - Run Localized Digital Ads

Launch targeted ads on Google Ads and Facebook aimed at users within a 10–20 mile radius. Use keywords like “storage units near me” or “climate-controlled storage in [ZIP code].” - Offer Introductory Promotions

Attract first-time renters with offers like “First Month Free” or “$1 for the First Month.” Make sure your terms are clear to avoid confusion. - Leverage Email Marketing

Send monthly or quarterly emails to local realtors, home movers, small businesses, and contractors. Include facility updates, promo codes, and referral bonuses. - Use Local SEO and Content Marketing

Create a blog or FAQ section on your website targeting terms like “best storage facility in [city],” “RV storage tips,” or “how to pack a storage unit.” This drives organic traffic and builds trust. - Build Partnerships

Collaborate with moving companies, real estate agents, or home improvement stores for cross-promotions.

Case Study: Real-Life Success Story (Ohio, 2021–2025)

Image source: i.pinimg.com

In 2021, a husband-and-wife team in Ohio acquired a 100-unit mini storage facility for $750,000. Initially, the property had outdated signage, minimal curb appeal, and low tenant engagement. Over the next two years, the owners took several low-cost but impactful steps:

- Repainted exteriors and improved lighting

- Rebranded with updated signage and local SEO presence

- Upgraded gate access and online booking

- Increased unit rental rates by 15% after improving security and appearance

As a result, their monthly income jumped from $7,000 to $10,500, and occupancy improved to 96%. In early 2025, the facility was professionally appraised at $1.4 million, nearly doubling their initial investment value.

This case illustrates how strategic, incremental upgrades—without major capital expenditures—can significantly boost both revenue and overall property valuation.

Tax Advantages of Owning a Mini Storage Business

Image source: img.freepik.com

Owning a mini storage facility offers several attractive tax benefits that can significantly improve your bottom line:

- Deductible Operating Expenses: You can deduct standard business expenses such as mortgage interest, property taxes, insurance, utilities, repairs, and maintenance costs. These deductions reduce your taxable income.

- Depreciation Benefits: The IRS allows you to depreciate the property over 39 years (commercial real estate), even as its market value may rise. This non-cash expense can lower your tax liability each year.

- 1031 Exchange: If you sell your facility and reinvest the proceeds into another qualifying property, you may defer capital gains taxes under Section 1031 of the Internal Revenue Code. This strategy helps grow wealth tax-deferred.

- Bonus Depreciation (2025 Phase-Down): Though the 100% bonus depreciation is phasing down in 2025, investors may still benefit depending on the closing date and improvements made to the facility. Confirm eligibility with a tax professional.

- Local Tax Credits and Incentives: Some states or municipalities offer tax incentives for energy-efficient upgrades (e.g., solar panels) or economic development zones.

Pro Tip: Always consult with a qualified CPA or commercial real estate tax advisor to maximize your deductions and ensure compliance with federal and local laws.

Industry Trends for 2025

Image source: img.freepik.com

The mini storage sector continues to evolve in 2025, driven by innovation, consumer needs, and investment capital:

- Mixed-Use Developments Integrating Storage

Residential and retail developers are incorporating self-storage units into mixed-use complexes, especially in urban and suburban zones. This trend reflects a shift toward convenience and land-use efficiency. - Automation Reducing On-Site Staffing

Facilities are investing in smart gate access, mobile apps, and cloud-based management systems to reduce reliance on full-time staff, cut costs, and offer tenants a seamless experience. - Rising Interest from REITs and Investment Syndicates

Real Estate Investment Trusts (REITs) and private equity groups are actively acquiring and consolidating smaller facilities, increasing competition but also liquidity for sellers. - Strong Growth in Rural and Suburban Markets

As remote work and population shifts continue, demand for storage space is rising outside major metros. Markets like Boise, ID and Huntsville, AL are outperforming traditional urban centers in occupancy and rental growth.

Top Features Renters Want in 2025

Image source: www.ssauk.com

Modern renters have higher expectations than ever before. According to the SpareFoot & Self Storage Association (SSA) 2025 Report, these are the top features customers actively seek when choosing a storage facility:

|

Feature |

Percentage of Renters Seeking It |

|

24/7 Access |

78% |

|

Climate-Controlled Units |

66% |

|

Security Cameras |

85% |

|

Online Booking & Billing |

72% |

|

Drive-Up Unit Access |

59% |

Facilities that offer multiple high-demand features often enjoy higher occupancy, reduced churn, and the ability to charge premium rental rates. Investing in these features during upgrades or development can significantly boost long-term ROI.

Mini Storage vs. Other Commercial Real Estate (CRE) Assets

Image source: consensus-strategies.com

When evaluating where to invest in 2025, it’s important to compare mini storage with other types of commercial real estate (CRE). Storage facilities continue to outperform in several key areas such as ROI, maintenance, and staffing needs.

|

Asset Type |

Average ROI (2025) |

Tenant Turnover |

Maintenance Needs |

Staffing Required |

|

Mini Storage |

8% – 11% |

Low |

Low |

Minimal |

|

Retail Property |

6% – 8% |

Medium |

High |

Medium |

|

Office Space |

5% – 7% |

High |

Medium |

Medium |

|

Apartments |

7% – 9% |

Medium |

High |

High |

Why Mini Storage Leads:

- Higher ROI: Due to low overhead, flexible pricing, and strong occupancy.

- Lower Risk: Tenant default rarely causes major losses (prepaid monthly).

- Fewer Repairs: No plumbing, kitchens, or HVAC in most units.

- Lean Staffing: Many facilities are automated or managed remotely.

This comparison shows why many investors looking for predictable cash flow and minimal headaches are turning to mini storage over other real estate classes.

Exit Strategy Options

Image source: i.ytimg.com

Planning your exit strategy is just as important as the initial purchase. Successful investors often build their mini storage portfolio with a clear exit goal in mind. Here are four reliable and proven strategies to consider:

- Refinance After Increasing NOI

If you've improved net operating income through rent increases, cost reductions, or added services, you may qualify for a higher appraisal. This allows you to refinance the loan, pull out equity, and reinvest in new properties—while still holding the asset for future growth. - Sell to a REIT or Institutional Buyer

Real Estate Investment Trusts (REITs) and large portfolio managers often acquire profitable storage businesses. If your facility has consistent revenue, automation, and strong occupancy, it may attract high-value buyers looking for turnkey assets. Selling to a REIT can yield a premium over market value. - Bundle Multiple Facilities and Exit as a Portfolio

If you own multiple small or mid-sized facilities in similar regions, bundling them as a portfolio deal can raise your valuation. Buyers often pay more for multi-site operations due to scale efficiencies, brand recognition, and centralized management. - Franchise and Scale for Higher Resale Value

Converting your facility to a known brand or franchising your model can increase marketability. Franchise brands like Storage Authority or CubeSmart offer marketing power and tech tools that appeal to larger investors or new buyers seeking turnkey options. This approach can elevate your asking price when it’s time to sell.

Top Cities for 2025 Investment

Image source: miro.medium.com

If you're searching for a mini storage business for sale, location matters just as much as price or size. Based on current real estate trends, population migration, and storage demand metrics, these five cities are among the most promising for investors in 2025:

|

City |

Key Investment Highlights |

|

Phoenix, AZ |

Rapid population growth, high home turnover, and steady rental demand in both urban and suburban zones. |

|

Tampa, FL |

Booming real estate market with strong inbound migration; favorable for passive investors. |

|

Charlotte, NC |

Business-friendly climate, rising job market, and expanding suburban developments fueling storage demand. |

|

Nashville, TN |

Strong economy, music/entertainment industries driving both residential and commercial storage use. |

|

Boise, ID |

Fastest-growing metro in the Northwest with limited self-storage saturation and rising rental rates. |

Source: U.S. Census 2024 Migration Report & SpareFoot Industry Data 2025

These cities combine high growth potential with relatively low market saturation, giving new and experienced investors a strategic advantage in acquiring or scaling profitable storage facilities.

Beginner Tips

Image source: i.pinimg.com

If you're just starting out in the mini storage industry, taking a cautious and informed approach can save you from costly mistakes. Here are some smart steps to follow:

- Start Small (Under 200 Units)

Begin with a manageable facility size. Smaller operations are easier to finance, operate, and learn from without overwhelming responsibilities or high capital risk. - Visit Existing Facilities

Spend time touring active storage businesses. Talk to owners and managers, observe traffic flow, security setups, unit conditions, and how customer service is handled. Real-world insights are invaluable. - Join SSA or Investor Communities

Become a member of the Self Storage Association (SSA) or online groups like BiggerPockets. These platforms offer investor tools, training, market data, and peer support to keep you informed and connected. - Use Property Management Software Early

Implement software like Tenant Inc., SiteLink, or Storage Commander from day one. These platforms automate bookings, billing, reporting, and tenant communication, helping even first-time owners manage professionally.

Read More: Before buying a facility, understanding how commercial leases work is crucial. Check out our guide on How to Rent Space for Your Small Business in 2025: Costs, States & Expert Lease Tips to learn the costs and best practices.

Conclusion

Investing in a mini storage business for sale in 2025 is one of the most reliable ways to build steady, long-term income. The industry is backed by strong demand, flexible operations, and resistance to economic downturns. Whether you’re managing it yourself or hiring professionals, today’s smart technology makes ownership easier than ever. With the right research, a solid business plan, and a good location, you can turn a storage facility into a highly profitable and scalable investment. Take your first step wisely—and watch your storage income grow.

FAQs

How much does it cost to buy a mini storage business?

Costs range from $400,000 for rural sites to over $5 million for urban facilities, depending on size, income, and location.

Is a mini storage business profitable?

Yes. Average ROI ranges from 8% to 11%, especially with value-add improvements.

What is the biggest risk in buying a facility?

Environmental issues or poor location choices. Always run due diligence.

Can I finance a storage facility?

Yes. SBA loans, seller financing, and commercial loans are common. A 10–30% down payment is typical.

Where can I find listings?

Try BizBuySell, LoopNet, Crexi, or contact local commercial brokers.

Selina Smith

Selina Smith

![AutoZone Business Hours [2025]: Complete Guide to Store Times, Holidays & Tips](https://statesidemagazine.com/uploads/images/2025/06/image_140x98_6852d31a1eb7b.jpg)